Trumponomics, trade, and stateless money

by John MacBeath Watkins

We're hearing a lot about the trade deficit lately, and Donald Trump got elected in part based on his claim that he could turn this around.

How will he do that? Well, if the recent Carrier deal is an example, by bribing companies with tax dollars and browbeating those businesses. He's also claimed he would put a 35% import duty on goods produced by factories relocated outside the United States (but not, apparently, on the foreign companies they compete with.)

Import substitution, that is, raising duties and attempting to have more things built in the homeland, did not work very well for Argentina, and is unlikely to work well for the United States. Furthermore, it appears he intends to give big tax breaks to the rich. I believe there are ties between inequality and trade, at least in the American economy.

Now, here's a chart from The Motley Fool showing the history of the U.S. trade deficit.

We're hearing a lot about the trade deficit lately, and Donald Trump got elected in part based on his claim that he could turn this around.

How will he do that? Well, if the recent Carrier deal is an example, by bribing companies with tax dollars and browbeating those businesses. He's also claimed he would put a 35% import duty on goods produced by factories relocated outside the United States (but not, apparently, on the foreign companies they compete with.)

Import substitution, that is, raising duties and attempting to have more things built in the homeland, did not work very well for Argentina, and is unlikely to work well for the United States. Furthermore, it appears he intends to give big tax breaks to the rich. I believe there are ties between inequality and trade, at least in the American economy.

Now, here's a chart from The Motley Fool showing the history of the U.S. trade deficit.

When Europe started rebuilding after World War II, we had massive trade surplus. How could other countries afford to pay for that? Well, we were shipping them plenty of capital, though the Marshall Plan and private investment. Then, we went through an extended period when trade was roughly balanced, from about 1950 to the mid-1970s, when the oil shocks changed everything.

It was after this that the great decline came, and not just in the trade deficit. Current accounts went into deficit as well.

Essentially, we've been borrowing money and spending it on foreign goods. In part, this is because of deliberate sterilization by China, that is, buying U.S. debt so that the Chinese trade surplus would not cause its currency to appreciate, which would tend to correct for the imbalance. China started doing this in the 1990s. In 2005, they began letting their currency appreciate, but they don't seem to have slowed up on building their dollar reserves until around the end of 2013.

That's only part of how consumption has been paid for. Other capital flows would be earnings parked overseas for tax reasons, foreign money parked in America by nervous foreigners looking for safety, inflows of private investment, money spent by tourists here and abroad, etc. The biggest factor in the current account is the trade surplus or deficit. All in all, the current account shows whether a country's net foreign assets are increasing or decreasing, and ours have been decreasing since about 1982, with upticks in the late 1980s as the price of oil declined and after the Chinese allowed their currency to appreciate after 2005. Aside from those, rising consumption is being paid for with borrowed money. And the Chinese example of sterilization shows how that's possible.

Now, the question remains, what happened in 1982? We know what happened later in the decade, the Japanese Yen increased in value and the terms of trade no longer allowed our (then) largest trading partner to keep building huge trade surpluses, and lower oil prices reduced the trade deficit.. But aside from that reprieve, trade deficits have tended to grow.

I'm inclined to suspect that this has something to do with changes in the structure of our economy. Changes in banking allowed raiders to finance hostile takeovers of established companies, the top tax rate went from 70% to 28%, the country became a more hostile place for unions, and rules were changed to allow stock buy-backs to become common. One result of all this was to move income from the lower and middle classes and up to the top earners. A side effect of this was to make capital more mobile.

Middle class people tend to keep their money in savings and investments that they can quickly get at is circumstances require. If they start a business, it's likely to be a local business, a hardware store, a hair salon, something that keeps the money local. But there again, they run into rules changes. For example, when Reagan came into office, the Justice Department changed the way it enforced anti-trust rules. Anti-competitive practices like predatory pricing used to be treated as illegal. Now, in most cases, the Justice Department is only interested in collusion to raise prices. This has tended to favor the Walmarts of the world over the mom and pop stores.

Those at the top level of income are more likely to invest internationally, and as we saw when the Panama Papers became public, they may move money abroad to avoid taxes. Of course, they might have done that before the 1980s, but when wealth is very concentrated, as it is now, more of it belongs to people who see large benefits in tax havens. And even that may be dwarfed by the amount of stateless money corporations are keeping abroad to reduce their taxes.

I'm not sure there is anything like a 1:1 correspondence of inequality and stateless money, or of stateless money and trade deficits, but I think it's time to examine the question. Something has gone haywire, and the timing suggests to me that changing the rules of the game so that more of the money went to those at the top played a key role.

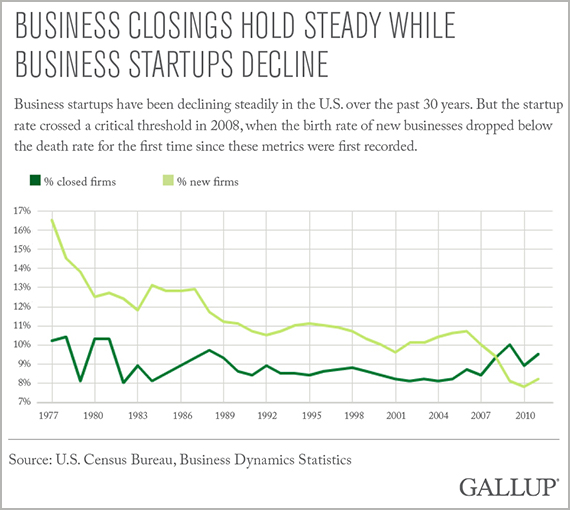

America used to be the most active country for small and medium-sized business startups. That pattern has changed, with a steady decline since the 1970s.

http://www.gallup.com/businessjournal/180431/american-entrepreneurship-dead-alive.aspx

As someone who has started a business, I can tell you, your own savings are the most reliable source of funds, and many startups are done with family money. As Harry Truman observed, a bank will loan you money if you can prove you don't need it. Inequality makes it harder for small businesses to get started, because it reduces the amount of savings available to the middle class.

And if you want more jobs to stay in America and more companies fit to export, you aren't going to get there by bullying or bribing existing large companies. A more equal distribution of income will allow people to buy things without borrowing the money, and more people to start up businesses to serve that demand. Cutting taxes on the rich will not serve this purpose.

Comments

Post a Comment