A plan to reduce inequity: Working versus owning

by John MacBeath Watkins

Everyone talks about inequity, but no one does anything about it. I propose to examine how we got where we are, and what we should do to reverse the situation. It seems to me that on both left and right, there is a longing for a time when the economy worked better for the average Joe, and I mean to find out how we lost it and how to get it back.

I am now well stricken in years. My legs are grey. My ears are gnarled. My eyes are old and bent. I remember the time conservatives long for, when a man could call his home his own, his wife would be waiting with a martini when he got home, everyone smoked, even your doctor, and if you worked hard and remembered to be white and male, the world was your oyster or some similar mollusk.

One feature of this world was that the middle class had a decent income. A one-income family could afford to own a house, run a couple of cars and even send the kids to college.

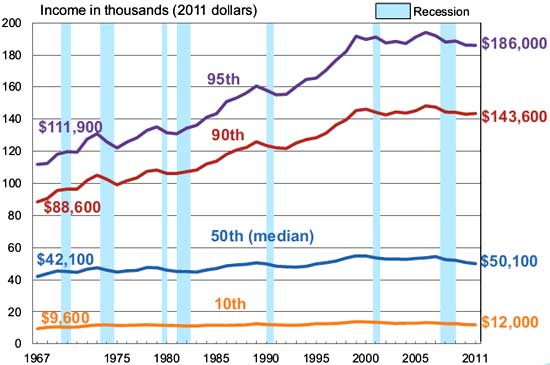

Things have changed. Median income for male workers has been declining since 1973, while women are more likely to be working and are making better money.

(from here: http://marginalrevolution.com/marginalrevolution/2011/06/the-great-male-stagnation.html)

For a while, two-income households managed to keep the median household income rising until 2000. Now, median household income has fallen to the level of about 1979.

(from here: http://www.cleveland.com/datacentral/index.ssf/2012/09/historical_median_household_in.html)

As you can see from this chart, most of the increases in income have gone to those at the higher end of the income scale, while the poor haven't gained much since the mid-1980s, and the median have gained some, then lost some. As society as a whole has become more prosperous, the gains have mostly gone to those at the higher end of the scale. How did that happen?

Part of the story is taxes. During World War II, congress imposed a 94% top tax bracket. Few people paid it, but it was a way of saying, we're all making sacrifices, we're all in this together. Now, say what you will about Arthur Laffer, the Laffer Curve, which he did not invent (that honor belongs to an Arab thinker about 1,000 years ago) if you have high enough taxes, it does apply. Recent research indicates it applies to rates above 70%, which means that Jack Kennedy took care of that problem in the 1964.

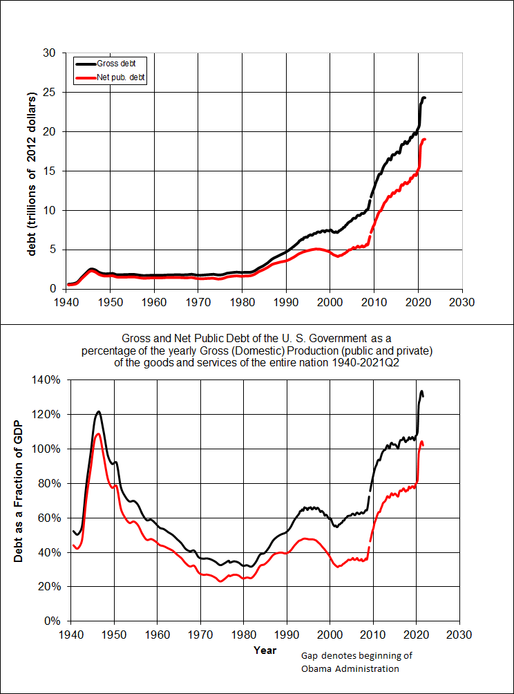

Attempts to apply the Laffer Curve after the problem was already solved did nothing but help increase the share of national income the richest people got to keep. It did not stimulate the economy so much that tax revenues actually increased, as Laffer promised. It just resulted in more debt.

During the Reagan Administration, we lowered the top marginal tax rate from 70% to, eventually, 28%. But some taxes were increased. When Reagan entered office, payroll taxes (Social Security and Medicare) were 9.9%. By the time George H. W. Bush left office, they were 12.4%.

Now, something that occasionally makes the rounds is the idea of a flat tax, as if calculating our tax rate were particularly difficult after we'd worked out all our deductions. Usually, the idea is to not tax incomes below a certain level, so that it's fairer for the poor. The payroll tax is a flat tax turned upside down: It applies to the first dollar you make, but any amount you make above the base wage ($117,000 for 2014) isn't taxed.

Since payroll taxes are part of the unified budget, this amounted to cutting the top tax rate while increasing the regressive inverted flat tax of the payroll tax. Meanwhile, the capital gains tax, which peaked above 40% during the Ford Administration, is now 15%, the lowest it has been since shortly after Herbert Hoover left office.

People who make a living by owning things, which used to be called the rentier class, tend to be the ones paying the capital gains tax rather than the payroll tax or ordinary income tax. The system can also be manipulated to turning what looks like ordinary income into "capital gains" for tax purposes. Greg Mankiw provides an example of that in what I suppose was intended to be a defense of capital gains taxation of, for example, hedge fund managers.

Here are some of Mankiw's examples:

In fact, we're so sure owning is better than working, we have a top marginal rate of 39.6% on earned income, and a top capital gains tax rate of 15%. We are so in love with the virtues of owning, we reward it by charging a lower tax rate for it, and charge 2.64 times as much tax for those misguided saps who work for a living. Add in the payroll taxes, it's more like 3 times the tax rate if you're working instead of owning.

Well, what makes owning better than working? The oft-repeated theory is that if we encourage investment, the economy will be better and we'll all be better off. Another version of the argument is that we should use consumption taxes to encourage savings, because saving is better than consuming. This is an odd argument, because encouraging saving is also encouraging borrowing. In national income accounting, savings has to equal investment -- government borrowing and private borrowing have to equal private savings and foreign capital inflows. This isn't controversial, it's how the savings accounting identity is defined.

So when you complain about the financialization of the economy, remember, all that investment income is savings, and when you have a giant pool of money, it has to be loaned in order to make it grow. One reason that the pool of money in the 2000s was so giant was that China was operating its economy much the way America was in the 1920s. They were exporting mightily, and when you earn a lot of money this way, it usually means that lots of money comes into your country and that causes inflation, so that the low wages that made you a super-competitive exporter increase, and you lose your advantage.

The people running China didn't want that to happen. So, they didn't keep the money in China. They "sterilized" their export income by buying securities in countries they wanted to export to. America and France did something similar in the 1920s, and it ultimately undermined international trade and contributed to the financial collapse that led to the Depression. The problem is, these actions produce a giant pool of money -- excess savings -- chasing good investments in the country targeted for sterilization. And that produces financial bubbles.

A model that says savings and investment are better than working and consuming will tend to this sort of thing. And surely, the whole point of an economy is to produce things and consume them. So why have we valorized owning things over making and consuming them?

Well, one way of justifying this view is to say that if we encourage people to invest and realize capital gains instead or working for a living, we'll have a more prosperous society in the end, and a rising tidesinks raises all boats. A low capital gains tax will encourage this sort of prosperity, we're told.

Only there's no actual evidence this is so. Len Burman, a professor of economics at Syracuse University’s Maxwell School, has run the numbers on all the natural experiments we've had in this regard as the capital gains tax has gone up and down. Here's what he found:

At a minimum, Leonard Burman has shown that raising or lowering the capital gains tax doesn't seem all that influential. So why penalize earning money as wages relative to making money on investments?

Well, it may have something to do with power. People who make the bulk of their money as capital gains tend to be wealthier and better connected. And they tend, more than wage earners do, to be U.S. senators.

Less than 10% of Americans have a net worth of $1 million or more. In the U.S. Senate, 66 of 100, or two-thirds, are millionaires. High net worth individuals, by definition, own a lot of stuff, so capital gains taxes are important to them. Both your senator and his or her biggest campaign donors and bundlers tend to care a lot about capital gains. So if you expect them to be treated no better than working for a living, you're starting in hard luck. The people writing the laws are rich, the people writing the checks to the people writing the laws are rich, and the rich get most of their income from capital gains.

We've had enough experience to know Burman is right, so the only possible explanation for the continued coddling of the rich is that the tax laws are written for and by them. The way to change that is to bring it front and center in our national conversation, so that they can stop lying about their reasons for treating their investments better than your wages.

If we're going to value work as much as owning, we need to do something about the upside-down flat tax on wages. We ought not to be charging any payroll taxes on people's earnings below the poverty line. We can make up for that by raising the base wage, and by taxing all income the same for social insurance purposes. If you are making less than $11,490 and you are a single person, why should you pay 12.4 percent tax, when the Koch brothers, when they sell off a $100 million block of stock, pay hardly any more tax on it (if their accountants haven't found a way to make sure they pay no tax at all.)

Now, suppose they paid $90 million for that stock, and their profit is $10 million. Should they pay less tax on that $10 million than a basketball player with a $10 million salary? I can't see why they should. They didn't work any harder, and even if they didn't make a dime on that stock, they'd still have $90 million.

And why should there be no payroll tax on earned income above $117,000 a year? Why not $500,000 a year? The higher the base wage, the lower the rate needs to be. We can make up for the payroll taxes lost by not taxing the poor by taxing the affluent a bit more. Reagan sold an increase in the tax rate on payrolls as needed to keep the Social Security Fund solvent, but raising the base wage would have worked as well. For that matter, when the Highway Trust Fund became insolvent, congress didn't increase taxes, they just topped it up from the general fund. Keep this in mind when you hear people hyperventilating about the Social Security trust fund.

In effect, he raised taxes on working families and lowered taxes on the rich, with the revenues from tax increase on workers making the lost revenue of his tax cuts on the rich look less like an invitation to bankrupting the country.

This represented a major transfer of wealth from people who make less than the maximum basis wage to those who make a whole lot of money. And since then, we've lowered taxes on the way the rich tend to make money -- capital gains -- while keeping that higher payroll tax in place on people working for wages.

George W. Bush pushed for what he called an "ownership society," in which, for example, we'd all own investments in a retirement account instead of having a guaranteed benefit through Social Security. But as we've seen, one man's savings is another man's debt, unless, like Smaug, you choose to sleep on a bed of gold. And by taking his wealth out of circulation (and by frying anyone who tried to work the land) Smaug made the world poorer.

The alternative to owning investments and building up debt is the "pay as you go society." That's how Social Security is designed, so that it works as a compact between the generations. People of working age are taking care of old people, knowing that the next generation will take care of them.

While savings and debt certainly have a place, no one has yet explained to me why a pyramid of savings and debt is better than paying your way, which makes our treatment of investing as contributing more to wealth than working all the more puzzling.

Wealth tax:

Redistributing earnings from the middle class and the poor to high earners is one way of increasing inequity. We might redress some of this with a tax on wealth.

Henry George, a 19th century political economist, advocated a "single tax," a tax on land value, which he argued would go some way to solving the problem of inequity.

George argued that the reason increasing poverty accompanied increasing wealth was that as population increased, land values increased, so that working men had to pay more for the privilege of working the land.

There are some problems with this idea. Study after study has shown that property valuations are essentially regressive. When properties sell, you can compare their valuation to their selling prices. High-value properties are consistently under valued by this standard, and low-value properties are typically over valued.

The only place something like this has been made to work was Hong Kong, where the colony leased the land from China and subleased it to businesses and homeowners. Leases went for market rates, and by all accounts, the system worked very well. Without those special circumstances, I doubt the single tax is really workable.

Other than property taxes, the wealth tax we have now is the estate tax, which has been under assault by certain politicians and their paymasters for years. In 2001, it applied to estates above $675,000 in value, and the top rate was 55%. Currently, it applies to estates of more than $5.25 million, and the top rate is 40%. This has had a predictable effect on the number of estates to which the estate tax applies:

(The chart is from here: http://en.wikipedia.org/wiki/Estate_tax_in_the_United_States )

As you can see, the number of estates affected by the tax went down dramatically during the Reagan and George W. Bush administrations, up during the George H.W. Bush and Clinton administrations. Reagan and Bush II both exploded the national debt, while Bush I and Clinton worked to reduce it.

We have, in effect, reduced taxes on high incomes, investment incomes, and large estates, while increasing taxes on low and ordinary incomes and on wages.

And we wonder why inequity increases.

A Plan

So, to start with, let's lower taxes on working and on low wages, by exempting wages below the poverty line from the payroll tax. We can make up for this by applying payroll taxes to higher incomes than we do now.

Let's stop privileging owning over working. Tax capital gains like earned income. Face it, creating giant pools of money leads to financial bubbles, and in a mature economy, to have investment opportunities, you need consumption. That means you need people working and paying as they go, not just saving and lending. We've got the balance wrong right now, and we need to move it back toward working.

As I write this, we're slowly coming out of a recession, which means we have too much unemployment because of a lack of aggregate demand in the economy. But there is such a thing as a "natural rate" of unemployment, defined as the rate at which lowering interest rates produces more inflation without producing more jobs. To a great extent, this means workers' skills don't match the remaining work that needs doing. We can reduce the natural rate of unemployment by increasing worker skills.

Unfortunately, we've been moving in the other direction, defunding schools and forcing people to go deeply into debt to acquire the skills they need to develop a career.

We need to provide funds for educating our workforce. Public universities can't push tuition up indefinitely and students can't take on unlimited debt. A skilled workforce works and pays taxes. We seem to have forgotten the public benefit of helping people get better skills.

There's been some speculation that we are entering a period of stagnation. Bullshit. If we didn't invest in our factories, we'd enter a period of stagnation. We've greatly slowed our investment in public goods, and that's producing stagnation. Dwight Eisenhower thought the greatest achievement of his presidency was the Interstate Highway System. He understood that to mobilize a great nation, you need to get the logistics right, and building the highways would make the country more productive.

But since the late 1960s, we've spent too little on public goods. Democrats cared more about programs like Social Security, Republicans cared more about defense spending and cutting taxes. Here's the result:

(from this source: http://www.economist.com/blogs/gulliver/2010/12/age_americas_infrastructure)

President Obama has the right idea with his notion of an infrastructure bank, but the loyal opposition seems to think that only private investment increases productivity. Next time you're stuck in a traffic jam, think of all the hours being lost for the want of some transportation spending. Another problem is that we don't get as much per dollar for our infrastructure spending as other developed countries, so we should take a good hard look at the way they do this and learn what we can.

It's always easier to divvy up a growing pie, and we can grow the pie. In doing so, we can put the country back to work.

And if we're to get back to an economy where we work and pay our way, growth and greater equality will have to go hand in hand. As economist Walter Frick noted, “given the diminishing marginal utility of income, it’s hugely wasteful for the super rich to have so much income."

Everyone talks about inequity, but no one does anything about it. I propose to examine how we got where we are, and what we should do to reverse the situation. It seems to me that on both left and right, there is a longing for a time when the economy worked better for the average Joe, and I mean to find out how we lost it and how to get it back.

I am now well stricken in years. My legs are grey. My ears are gnarled. My eyes are old and bent. I remember the time conservatives long for, when a man could call his home his own, his wife would be waiting with a martini when he got home, everyone smoked, even your doctor, and if you worked hard and remembered to be white and male, the world was your oyster or some similar mollusk.

One feature of this world was that the middle class had a decent income. A one-income family could afford to own a house, run a couple of cars and even send the kids to college.

Things have changed. Median income for male workers has been declining since 1973, while women are more likely to be working and are making better money.

For a while, two-income households managed to keep the median household income rising until 2000. Now, median household income has fallen to the level of about 1979.

(from here: http://www.cleveland.com/datacentral/index.ssf/2012/09/historical_median_household_in.html)

As you can see from this chart, most of the increases in income have gone to those at the higher end of the income scale, while the poor haven't gained much since the mid-1980s, and the median have gained some, then lost some. As society as a whole has become more prosperous, the gains have mostly gone to those at the higher end of the scale. How did that happen?

Part of the story is taxes. During World War II, congress imposed a 94% top tax bracket. Few people paid it, but it was a way of saying, we're all making sacrifices, we're all in this together. Now, say what you will about Arthur Laffer, the Laffer Curve, which he did not invent (that honor belongs to an Arab thinker about 1,000 years ago) if you have high enough taxes, it does apply. Recent research indicates it applies to rates above 70%, which means that Jack Kennedy took care of that problem in the 1964.

Attempts to apply the Laffer Curve after the problem was already solved did nothing but help increase the share of national income the richest people got to keep. It did not stimulate the economy so much that tax revenues actually increased, as Laffer promised. It just resulted in more debt.

|

| from here. |

During the Reagan Administration, we lowered the top marginal tax rate from 70% to, eventually, 28%. But some taxes were increased. When Reagan entered office, payroll taxes (Social Security and Medicare) were 9.9%. By the time George H. W. Bush left office, they were 12.4%.

Now, something that occasionally makes the rounds is the idea of a flat tax, as if calculating our tax rate were particularly difficult after we'd worked out all our deductions. Usually, the idea is to not tax incomes below a certain level, so that it's fairer for the poor. The payroll tax is a flat tax turned upside down: It applies to the first dollar you make, but any amount you make above the base wage ($117,000 for 2014) isn't taxed.

Since payroll taxes are part of the unified budget, this amounted to cutting the top tax rate while increasing the regressive inverted flat tax of the payroll tax. Meanwhile, the capital gains tax, which peaked above 40% during the Ford Administration, is now 15%, the lowest it has been since shortly after Herbert Hoover left office.

People who make a living by owning things, which used to be called the rentier class, tend to be the ones paying the capital gains tax rather than the payroll tax or ordinary income tax. The system can also be manipulated to turning what looks like ordinary income into "capital gains" for tax purposes. Greg Mankiw provides an example of that in what I suppose was intended to be a defense of capital gains taxation of, for example, hedge fund managers.

Here are some of Mankiw's examples:

• Carl is a real estate investor and a carpenter. He buys a dilapidated house for $800,000. After spending his weekends fixing it up, he sells it a couple of years later for $1 million. Once again, the profit is $200,000

• Dan is a real estate investor and a carpenter, but he is short of capital. He approaches his friend, Ms. Moneybags, and they become partners. Together, they buy a dilapidated house for $800,000 and sell it later for $1 million. She puts up the money, and he spends his weekends fixing up the house. They divide the $200,000 profit equally.

• Earl is a carpenter. Ms. Moneybags buys a dilapidated house for $800,000 and hires Earl to fix it up. After paying Earl $100,000 for his services, Ms. Moneybags sells the home for $1 million, for a profit of $100,000....

...(snip)...

This brings us to Dan and his partnership with Ms. Moneybags. The tax law treats this partnership as exactly equivalent to Carl’s situation. In this case, however, the $200,000 capital gain is divided into halves: some of it goes to Ms. Moneybags, who provided the cash, and some goes to Dan, who provided the sweat equity. Once again, nothing is treated as ordinary income.

Now, here's a question. If it's hard to say which tax applies, why are we charging different rates? It appears we have decided to reward owning over working, and tax dodges designed to make it look like we're owning over admitting that we're working.

In fact, we're so sure owning is better than working, we have a top marginal rate of 39.6% on earned income, and a top capital gains tax rate of 15%. We are so in love with the virtues of owning, we reward it by charging a lower tax rate for it, and charge 2.64 times as much tax for those misguided saps who work for a living. Add in the payroll taxes, it's more like 3 times the tax rate if you're working instead of owning.

Well, what makes owning better than working? The oft-repeated theory is that if we encourage investment, the economy will be better and we'll all be better off. Another version of the argument is that we should use consumption taxes to encourage savings, because saving is better than consuming. This is an odd argument, because encouraging saving is also encouraging borrowing. In national income accounting, savings has to equal investment -- government borrowing and private borrowing have to equal private savings and foreign capital inflows. This isn't controversial, it's how the savings accounting identity is defined.

So when you complain about the financialization of the economy, remember, all that investment income is savings, and when you have a giant pool of money, it has to be loaned in order to make it grow. One reason that the pool of money in the 2000s was so giant was that China was operating its economy much the way America was in the 1920s. They were exporting mightily, and when you earn a lot of money this way, it usually means that lots of money comes into your country and that causes inflation, so that the low wages that made you a super-competitive exporter increase, and you lose your advantage.

The people running China didn't want that to happen. So, they didn't keep the money in China. They "sterilized" their export income by buying securities in countries they wanted to export to. America and France did something similar in the 1920s, and it ultimately undermined international trade and contributed to the financial collapse that led to the Depression. The problem is, these actions produce a giant pool of money -- excess savings -- chasing good investments in the country targeted for sterilization. And that produces financial bubbles.

A model that says savings and investment are better than working and consuming will tend to this sort of thing. And surely, the whole point of an economy is to produce things and consume them. So why have we valorized owning things over making and consuming them?

Well, one way of justifying this view is to say that if we encourage people to invest and realize capital gains instead or working for a living, we'll have a more prosperous society in the end, and a rising tide

Only there's no actual evidence this is so. Len Burman, a professor of economics at Syracuse University’s Maxwell School, has run the numbers on all the natural experiments we've had in this regard as the capital gains tax has gone up and down. Here's what he found:

If low capital gains tax rates catalyzed economic growth, you’d expect to see a negative relationship–high gains rates, low growth, and vice versa–but there is no apparent relationship between the two time series. The correlation is 0.12, the wrong sign and not statistically different from zero. I’ve tried lags up to five years and also looking at moving averages of the tax rates and growth. There is never a statistically significant relationship.

Does this prove that capital gains taxes are unrelated to economic growth? Of course not. Many other things have changed at the same time as gains rates and many other factors affect economic growth. But the graph should dispel the silver bullet theory of capital gains taxes. Cutting capital gains taxes will not turbocharge the economy and raising them would not usher in a depression.

If

low capital gains tax rates catalyzed economic growth, you’d expect to

see a negative relationship–high gains rates, low growth, and vice

versa–but there is no apparent relationship between the two time series.

The correlation is 0.12, the wrong sign and not statistically

different from zero. I’ve tried lags up to five years and also looking

at moving averages of the tax rates and growth. There is never a

statistically significant relationship. - See more at:

http://taxvox.taxpolicycenter.org/2012/03/19/no-obvious-relationship-between-capital-gains-tax-rates-and-economic-growth/#sthash.SX6N1KCe.dpuf

That's from here: http://taxvox.taxpolicycenter.org/2012/03/19/no-obvious-relationship-between-capital-gains-tax-rates-and-economic-growth/At a minimum, Leonard Burman has shown that raising or lowering the capital gains tax doesn't seem all that influential. So why penalize earning money as wages relative to making money on investments?

Well, it may have something to do with power. People who make the bulk of their money as capital gains tend to be wealthier and better connected. And they tend, more than wage earners do, to be U.S. senators.

Less than 10% of Americans have a net worth of $1 million or more. In the U.S. Senate, 66 of 100, or two-thirds, are millionaires. High net worth individuals, by definition, own a lot of stuff, so capital gains taxes are important to them. Both your senator and his or her biggest campaign donors and bundlers tend to care a lot about capital gains. So if you expect them to be treated no better than working for a living, you're starting in hard luck. The people writing the laws are rich, the people writing the checks to the people writing the laws are rich, and the rich get most of their income from capital gains.

We've had enough experience to know Burman is right, so the only possible explanation for the continued coddling of the rich is that the tax laws are written for and by them. The way to change that is to bring it front and center in our national conversation, so that they can stop lying about their reasons for treating their investments better than your wages.

If we're going to value work as much as owning, we need to do something about the upside-down flat tax on wages. We ought not to be charging any payroll taxes on people's earnings below the poverty line. We can make up for that by raising the base wage, and by taxing all income the same for social insurance purposes. If you are making less than $11,490 and you are a single person, why should you pay 12.4 percent tax, when the Koch brothers, when they sell off a $100 million block of stock, pay hardly any more tax on it (if their accountants haven't found a way to make sure they pay no tax at all.)

Now, suppose they paid $90 million for that stock, and their profit is $10 million. Should they pay less tax on that $10 million than a basketball player with a $10 million salary? I can't see why they should. They didn't work any harder, and even if they didn't make a dime on that stock, they'd still have $90 million.

And why should there be no payroll tax on earned income above $117,000 a year? Why not $500,000 a year? The higher the base wage, the lower the rate needs to be. We can make up for the payroll taxes lost by not taxing the poor by taxing the affluent a bit more. Reagan sold an increase in the tax rate on payrolls as needed to keep the Social Security Fund solvent, but raising the base wage would have worked as well. For that matter, when the Highway Trust Fund became insolvent, congress didn't increase taxes, they just topped it up from the general fund. Keep this in mind when you hear people hyperventilating about the Social Security trust fund.

In effect, he raised taxes on working families and lowered taxes on the rich, with the revenues from tax increase on workers making the lost revenue of his tax cuts on the rich look less like an invitation to bankrupting the country.

This represented a major transfer of wealth from people who make less than the maximum basis wage to those who make a whole lot of money. And since then, we've lowered taxes on the way the rich tend to make money -- capital gains -- while keeping that higher payroll tax in place on people working for wages.

George W. Bush pushed for what he called an "ownership society," in which, for example, we'd all own investments in a retirement account instead of having a guaranteed benefit through Social Security. But as we've seen, one man's savings is another man's debt, unless, like Smaug, you choose to sleep on a bed of gold. And by taking his wealth out of circulation (and by frying anyone who tried to work the land) Smaug made the world poorer.

The alternative to owning investments and building up debt is the "pay as you go society." That's how Social Security is designed, so that it works as a compact between the generations. People of working age are taking care of old people, knowing that the next generation will take care of them.

While savings and debt certainly have a place, no one has yet explained to me why a pyramid of savings and debt is better than paying your way, which makes our treatment of investing as contributing more to wealth than working all the more puzzling.

Wealth tax:

Redistributing earnings from the middle class and the poor to high earners is one way of increasing inequity. We might redress some of this with a tax on wealth.

Henry George, a 19th century political economist, advocated a "single tax," a tax on land value, which he argued would go some way to solving the problem of inequity.

George argued that the reason increasing poverty accompanied increasing wealth was that as population increased, land values increased, so that working men had to pay more for the privilege of working the land.

There are some problems with this idea. Study after study has shown that property valuations are essentially regressive. When properties sell, you can compare their valuation to their selling prices. High-value properties are consistently under valued by this standard, and low-value properties are typically over valued.

The only place something like this has been made to work was Hong Kong, where the colony leased the land from China and subleased it to businesses and homeowners. Leases went for market rates, and by all accounts, the system worked very well. Without those special circumstances, I doubt the single tax is really workable.

Other than property taxes, the wealth tax we have now is the estate tax, which has been under assault by certain politicians and their paymasters for years. In 2001, it applied to estates above $675,000 in value, and the top rate was 55%. Currently, it applies to estates of more than $5.25 million, and the top rate is 40%. This has had a predictable effect on the number of estates to which the estate tax applies:

(The chart is from here: http://en.wikipedia.org/wiki/Estate_tax_in_the_United_States )

As you can see, the number of estates affected by the tax went down dramatically during the Reagan and George W. Bush administrations, up during the George H.W. Bush and Clinton administrations. Reagan and Bush II both exploded the national debt, while Bush I and Clinton worked to reduce it.

We have, in effect, reduced taxes on high incomes, investment incomes, and large estates, while increasing taxes on low and ordinary incomes and on wages.

And we wonder why inequity increases.

A Plan

So, to start with, let's lower taxes on working and on low wages, by exempting wages below the poverty line from the payroll tax. We can make up for this by applying payroll taxes to higher incomes than we do now.

Let's stop privileging owning over working. Tax capital gains like earned income. Face it, creating giant pools of money leads to financial bubbles, and in a mature economy, to have investment opportunities, you need consumption. That means you need people working and paying as they go, not just saving and lending. We've got the balance wrong right now, and we need to move it back toward working.

As I write this, we're slowly coming out of a recession, which means we have too much unemployment because of a lack of aggregate demand in the economy. But there is such a thing as a "natural rate" of unemployment, defined as the rate at which lowering interest rates produces more inflation without producing more jobs. To a great extent, this means workers' skills don't match the remaining work that needs doing. We can reduce the natural rate of unemployment by increasing worker skills.

Unfortunately, we've been moving in the other direction, defunding schools and forcing people to go deeply into debt to acquire the skills they need to develop a career.

We need to provide funds for educating our workforce. Public universities can't push tuition up indefinitely and students can't take on unlimited debt. A skilled workforce works and pays taxes. We seem to have forgotten the public benefit of helping people get better skills.

There's been some speculation that we are entering a period of stagnation. Bullshit. If we didn't invest in our factories, we'd enter a period of stagnation. We've greatly slowed our investment in public goods, and that's producing stagnation. Dwight Eisenhower thought the greatest achievement of his presidency was the Interstate Highway System. He understood that to mobilize a great nation, you need to get the logistics right, and building the highways would make the country more productive.

But since the late 1960s, we've spent too little on public goods. Democrats cared more about programs like Social Security, Republicans cared more about defense spending and cutting taxes. Here's the result:

(from this source: http://www.economist.com/blogs/gulliver/2010/12/age_americas_infrastructure)

President Obama has the right idea with his notion of an infrastructure bank, but the loyal opposition seems to think that only private investment increases productivity. Next time you're stuck in a traffic jam, think of all the hours being lost for the want of some transportation spending. Another problem is that we don't get as much per dollar for our infrastructure spending as other developed countries, so we should take a good hard look at the way they do this and learn what we can.

It's always easier to divvy up a growing pie, and we can grow the pie. In doing so, we can put the country back to work.

And if we're to get back to an economy where we work and pay our way, growth and greater equality will have to go hand in hand. As economist Walter Frick noted, “given the diminishing marginal utility of income, it’s hugely wasteful for the super rich to have so much income."

Comments

Post a Comment