How inequality suppresses national wealth

by John MacBeath Watkins

It is a curious thing, but the American economy, like those of other developed nations, does not appear to be managed to maximize national wealth.

Rather, it is managed to maximize profits, and to steer the distribution of wealth toward the already wealthy.

How does this work? For one thing, the most profitable situation for many companies is to have just enough slack in the labor market to suppress wages. The nation as a whole might be richer if wages were higher, leading to higher demand, but if more money goes to people working for wages, the people at the top benefit less.

From the 1940s through the 1960s, this was not in their control. That has changed.

An example is the decision by the Federal Reserve Bank to increase the federal funds rate by 25 basis points in December. The Fed is supposedly shooting for an inflation rate of 2%, yet with the core Consumer Price Index running at 1/10 of that, .2%, they decided to raise interest rates, something the Fed usually does to tamp down inflation.

The reasoning was that with unemployment down to 5%, inflation lurked on the horizon. But wages were increasing at a rate of 2.3%, making up some ground lost during the recession.

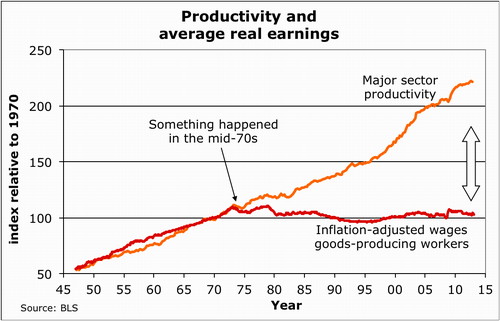

And wages have a special place in the Fed's deliberations. Since Milton Friedman proposed it in the 1970s, the Fed has considered the non-accelerating inflation rate of unemployment (NAIRU) as part of their deliberations. Since they accepted the idea, median wages have barely increased in real terms, while productivity has increased vastly.

There's a lot more to the phenomenon than the NAIRU, but the other elements are part of the same mindset. There is, for example, no real economic justification for the inflation target being 2% rather than, say, 3%, and considerable evidence that it leaves the economy perilously close to the zero lower bound (it's pretty hard, although not impossible, for interest rates to go below zero.) This can tie a central bank's hands when monetary stimulus is needed.

There has also been a major shift in how public corporations are managed. Shareholders used to be regarded as stakeholders in a corporation, much like bondholders, employees, and customers. In the 1970s and '80s, there was a major shift toward managing companies to maximize shareholder value.

This was based on the idea, advanced by Friedman, among others, that shareholders are owners, and a failure to maximize shareholder value was an owner/agent problem -- that is, the shareholders were owners, and management might operate the company in their own interest, rather than in the interest of shareholders. I went into some depth about why this is the wrong way to think about the problem in this post. I also recommend Lynn Stout's excellent book, The Shareholder Value Myth.

The NAIRU also accompanied a concerted effort to reduce employee leverage in wage negotiations by undercutting unions, for example, by passing "right to work" legislation state by state, which basically makes it impossible to have a union shop.

Now, there is a way to restore employee leverage over wages -- allow the unemployment rate to fall below NAIRU. After all, "non-accelerating inflation rate of unemployment" translated into plain English is "the rate of unemployment at which real wages do not rise."

http://www.huffingtonpost.com/stan-sorscher/we-decide-how-to-share-ga_b_3185721.html

The result of such a policy, in retrospect, is that the additional wealth produced by increase productivity does not go to the increasingly productive workers, but to people who do not work for hourly wages. That would be top management and shareholders. As Stan Sorscher notes in the Huffington Post article the above chart comes from, if wages had continued to track productivity, inflation adjusted wages would be about twice what they were in the early 1970s.

Imagine how much more wealth this country would have if this were the case. More money would be in the hands of people inclined to spend it, and the increased demand would cause industry to expand to fill it. Concentrating wealth in the hands of the top .1% leads to a lot of money looking for profitable investments that aren't there because of a lack of demand, resulting in bubbles. But that doubling of wages hasn't happened, because the economic elites have rigged the system to increase their positional status at the cost of making the country as a whole poorer.

What happens when unemployment falls below the NAIRU? What we saw in the late 1990s was that the labor participation rate increased, as people who had been out of the labor force discovered they could get jobs, and real wages started to rise.

Now, one would think that would be a shining example of what can be accomplished, and one to be followed.

But instead, we keep suppressing real wages, while demagogues work up anger among the white working class against immigrants and others they compete with for a piece of a pie that isn't growing.

If the average wage were twice what it is now, I submit that this would not be possible. Right now, people who work for wages see top managers getting richer while they don't, meaning their positional status is declining.

In addition, white male wages peaked in 1973. Women's wages have increased since then, so there is a loss of positional status here, as well. If the wages of both genders were growing, I doubt it would make much difference that women's wages are growing faster, but when you keep the size of the pie the same size and give more to someone, you set up a conflict.

http://www.washingtonmonthly.com/archives/individual/2007_10/012345.php

Not only are wages falling for white males, but labor participation if falling, so fewer are working for wages. While the male labor force participation rate has been falling since the mid 1950s, the female labor force participation rate was climbing until 2000. I strongly suspect we could create a lot more jobs without seeing much decline in the unemployment rate, because more people would come off the sidelines if they could.

The result is a world where it is easy to set one group against the other, and this is a handy way to distract people from the issue of who is actually getting the money that isn't going to working men.

When you've rigged the system, it's nice to have someone else to blame.

It is a curious thing, but the American economy, like those of other developed nations, does not appear to be managed to maximize national wealth.

Rather, it is managed to maximize profits, and to steer the distribution of wealth toward the already wealthy.

How does this work? For one thing, the most profitable situation for many companies is to have just enough slack in the labor market to suppress wages. The nation as a whole might be richer if wages were higher, leading to higher demand, but if more money goes to people working for wages, the people at the top benefit less.

From the 1940s through the 1960s, this was not in their control. That has changed.

An example is the decision by the Federal Reserve Bank to increase the federal funds rate by 25 basis points in December. The Fed is supposedly shooting for an inflation rate of 2%, yet with the core Consumer Price Index running at 1/10 of that, .2%, they decided to raise interest rates, something the Fed usually does to tamp down inflation.

The reasoning was that with unemployment down to 5%, inflation lurked on the horizon. But wages were increasing at a rate of 2.3%, making up some ground lost during the recession.

And wages have a special place in the Fed's deliberations. Since Milton Friedman proposed it in the 1970s, the Fed has considered the non-accelerating inflation rate of unemployment (NAIRU) as part of their deliberations. Since they accepted the idea, median wages have barely increased in real terms, while productivity has increased vastly.

There's a lot more to the phenomenon than the NAIRU, but the other elements are part of the same mindset. There is, for example, no real economic justification for the inflation target being 2% rather than, say, 3%, and considerable evidence that it leaves the economy perilously close to the zero lower bound (it's pretty hard, although not impossible, for interest rates to go below zero.) This can tie a central bank's hands when monetary stimulus is needed.

There has also been a major shift in how public corporations are managed. Shareholders used to be regarded as stakeholders in a corporation, much like bondholders, employees, and customers. In the 1970s and '80s, there was a major shift toward managing companies to maximize shareholder value.

This was based on the idea, advanced by Friedman, among others, that shareholders are owners, and a failure to maximize shareholder value was an owner/agent problem -- that is, the shareholders were owners, and management might operate the company in their own interest, rather than in the interest of shareholders. I went into some depth about why this is the wrong way to think about the problem in this post. I also recommend Lynn Stout's excellent book, The Shareholder Value Myth.

The NAIRU also accompanied a concerted effort to reduce employee leverage in wage negotiations by undercutting unions, for example, by passing "right to work" legislation state by state, which basically makes it impossible to have a union shop.

Now, there is a way to restore employee leverage over wages -- allow the unemployment rate to fall below NAIRU. After all, "non-accelerating inflation rate of unemployment" translated into plain English is "the rate of unemployment at which real wages do not rise."

http://www.huffingtonpost.com/stan-sorscher/we-decide-how-to-share-ga_b_3185721.html

The result of such a policy, in retrospect, is that the additional wealth produced by increase productivity does not go to the increasingly productive workers, but to people who do not work for hourly wages. That would be top management and shareholders. As Stan Sorscher notes in the Huffington Post article the above chart comes from, if wages had continued to track productivity, inflation adjusted wages would be about twice what they were in the early 1970s.

Imagine how much more wealth this country would have if this were the case. More money would be in the hands of people inclined to spend it, and the increased demand would cause industry to expand to fill it. Concentrating wealth in the hands of the top .1% leads to a lot of money looking for profitable investments that aren't there because of a lack of demand, resulting in bubbles. But that doubling of wages hasn't happened, because the economic elites have rigged the system to increase their positional status at the cost of making the country as a whole poorer.

What happens when unemployment falls below the NAIRU? What we saw in the late 1990s was that the labor participation rate increased, as people who had been out of the labor force discovered they could get jobs, and real wages started to rise.

Now, one would think that would be a shining example of what can be accomplished, and one to be followed.

But instead, we keep suppressing real wages, while demagogues work up anger among the white working class against immigrants and others they compete with for a piece of a pie that isn't growing.

If the average wage were twice what it is now, I submit that this would not be possible. Right now, people who work for wages see top managers getting richer while they don't, meaning their positional status is declining.

In addition, white male wages peaked in 1973. Women's wages have increased since then, so there is a loss of positional status here, as well. If the wages of both genders were growing, I doubt it would make much difference that women's wages are growing faster, but when you keep the size of the pie the same size and give more to someone, you set up a conflict.

http://www.washingtonmonthly.com/archives/individual/2007_10/012345.php

Not only are wages falling for white males, but labor participation if falling, so fewer are working for wages. While the male labor force participation rate has been falling since the mid 1950s, the female labor force participation rate was climbing until 2000. I strongly suspect we could create a lot more jobs without seeing much decline in the unemployment rate, because more people would come off the sidelines if they could.

The result is a world where it is easy to set one group against the other, and this is a handy way to distract people from the issue of who is actually getting the money that isn't going to working men.

When you've rigged the system, it's nice to have someone else to blame.

Comments

Post a Comment